Digital Operational Resilience Act (DORA)

Digital Operational Resilience Act (DORA)

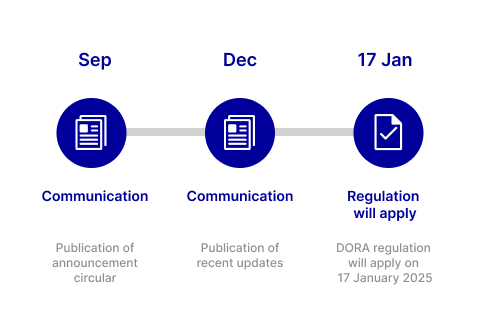

The Digital Operational Resilience Act (Regulation (EU) 2022/2554, “DORA”),is an EU regulation ultimately effective as of 17 January 2025. It aims to strengthen the resilience, reliability, and continuity of financial services across the European Union. DORA is designed to ensure that organizations can withstand, respond to, and recover from cyber incidents and therefore aims to strengthen the resilience, reliability, and continuity of financial services throughout the European Union.

The purpose of this Initiative page is to answer frequently asked questions with respect to the relationship between customers (in their role as Financial Entity) and Deutsche Börse AG.

Contacts