Xetra Trade-at-Close (TaC)

Xetra Trade-at-Close (TaC) Trade at closing auction price after market close

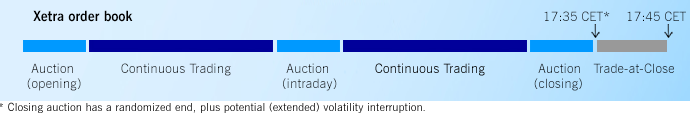

Xetra Trade-at-Close is a post close trading service on Xetra (MIC Code: XETR) launched in November 2020. It gives participants and investors the opportunity to trade after the closing auction at the official closing auction price.

Xetra TaC in a nutshell

- Enabled for all instruments on Xetra (bluechip shares, mid- and small-cap shares, ETFs and ETPs).

- Xetra TaC trading phase commences immediately after the end of the closing auction. The session is triggered only if the closing auction ended with a successful price determination and with positive turnover.

- Xetra TaC lasts a maximum of 10 min.

- Only opted in orders can participate in Xetra TaC.

- Market orders and limit orders with a price better than or equal to the closing price can participate in TaC.

- Orders participating in TaC are either non-executed orders transferred from the closing auction or new orders entered during TaC.

- During the session matching takes place continuously at a fixed and single price with time priority.

- Xetra TaC offers full pre and post trade transparency with immediate publication of executed transactions.

- Xetra TaC does not require any additional connectivity and no additional cost compared to the existing trading phases on Xetra.

Trading members are able to opt into TaC for the whole order flow on Trader ID level or on order by order basis. The initial default setting for all orders on a Trader ID level is opt out. Note that that ETI New Orders Single (short message) do not have order level flagging.

Video on Trade-at-Close: A short description of Xetra’s post close session