Xetra Midpoint

Xetra Midpoint Midpoint trading in German equities and European ETFs with reference market Xetra

Xetra Midpoint enables all trading participants to trade at the midpoint price that prevails directly at the heart of price discovery. Execution quality in Xetra Midpoint trading is superior to other trading venues: due to the latency-free connection to the reference market Xetra, execution of midpoint orders at a stale reference price is prevented and therefore any cross-venue latency arbitrage risk is eliminated.

Your advantages at a glance:

Xetra Midpoint is a highly consistent, easy to implement, and ready to use service

- No pre-trade transparency: Protect your intentions and prevent information leakage

- Zero latency to reference market Xetra: trading at the realtime midpoint price and strict sequencing and processing of incoming orders across Xetra Central Limit Order Book (CLOB) and Xetra Midpoint order book

- Potential price improvement: Save half the spread compared to aggressive execution in the Xetra Central Limit order book

- Reference Price Waiver: no order size restrictions and no tick size constraints for Xetra Midpoint execution prices and for optional order limits for Midpoint orders

- Efficient regulatory reporting: Dedicated reporting MICs for all trades concluded in Xetra Midpoint

- Attractive fees and launch incentive programme: sign up today

What it is

The Xetra Midpoint order book is “dark”. It is exempted from pre-trade transparency under a Reference Price Waiver. Orders in the Xetra Midpoint order book are not visible to any other market participant thus they are protected against information leakage.

In the Xetra Midpoint order book, orders are always executed at the midpoint of the currently available best bid/best ask spread in the Xetra Central Limit Order Book (CLOB) during continuous trading. All equities and ETFs for which Xetra itself is the reference market (“most relevant market in terms of liquidity” as per ESMA transparency calculations) are available.

For each trading day, the respective securities are marked in the current “XETRA All tradable instruments” csv file on the website and in the T7 Instrument Reference Data Interface (T7 RDI) in field “MidpointTrading” (column EP in csv file; field tag 28913 in T7 RDI). The reporting MIC for midpoint trades in each security is provided in field “MidpointExecutionVenueID” (column EQ in csv file; field tag 28914 in T7 RDI).

Newsletter

How it works

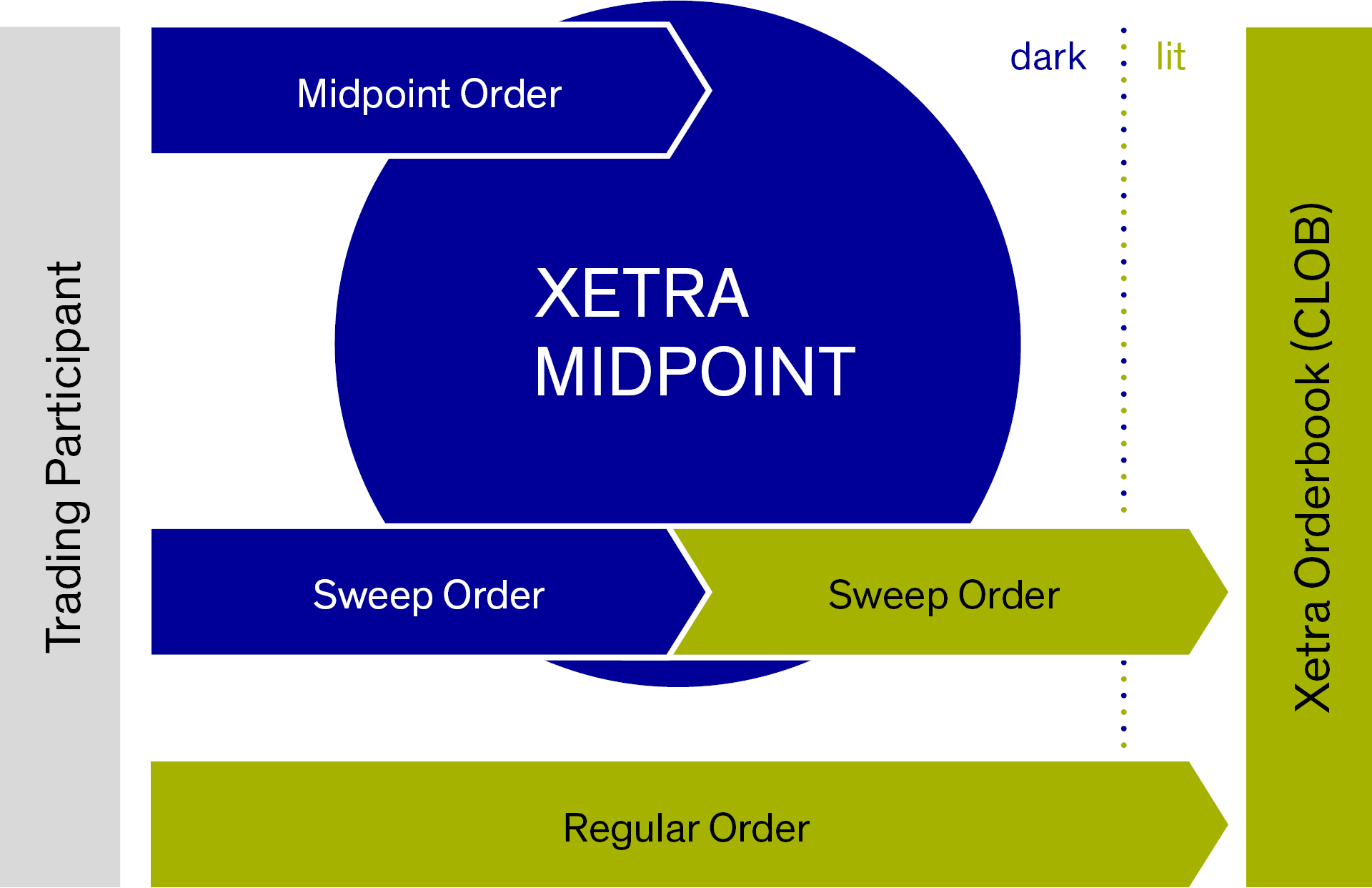

Trading participants can trade in the Xetra Midpoint order book by labelling any market order or limit order as either “Midpoint order” or “Sweep order”. Midpoint orders are entered into the Xetra Midpoint order book only, whereas Sweep orders will try to match against sitting Midpoint orders in the Xetra Midpoint order book. If no such match is possible, or if the Sweep order is only partially executable in the Xetra Midpoint order book, the Sweep order with its full or remaining quantity is forwarded instantly to the Xetra Central Limit Order Book (‘dark-to-lit’) and converted to a regular Market order or Limit order in the trading model “Continuous Trading with Auctions” and immediately executed there (if possible).

Key order features:

Order attribute | Midpoint order | Sweep order |

Execution | Xetra Midpoint order book only | Immediate execution in Xetra Midpoint order book if possible, automated transfer of remaining quantity to Xetra CLOB / trading model Continuous Trading with Auctions |

Limit |

|

|

Minimum Acceptable Quantity |

|

|

Immediate-or-Cancel |

|

|

Fill-or-Kill |

|

|

Book-or-Cancel | |

|

Validity restrictions |  |  |

Trading restrictions (auction only) |

|

|

Trade-at-Close |

|

|

Trading Capacity | Agency, Riskless Principle, Market Maker, Proprietary | Agency, Riskless Principle, Market Maker, Proprietary |

CrossID |

|

|

Xetra Midpoint Execution Fees and Incentive Programme: